Importing a car from other countries like Japan, China, Korea or any other country is a tricky task. You have to go through different processes like C&F charges, customs duties, custom agent fees, and lots of other taxes and duties. If you want to become familiar with all these procedures then this article is giving you complete details about Pakistan Car Import Duty 2025 Calculator and How to Pay custom duty of cars in Pakistan. But before start reading the details, I would like to tell you that in November 2018 the PM of Pakistan Imran Khan ordered the Federal Board of Revenue (FBR) to increase the customs duties on imported cars up to 30%. So that is why now you have to pay some extra charges then to the previous year’s duties. In this article, I am giving you the new custom duty rates on cars according to the mileage, displacement, and original price of a car. So let’s start reading….

Pakistan Car Import Duty 2025

Now, people who like Japanese vehicles now can check the Pakistan Car Import Duty 2025 that has been recently issued by the FBR.

| Vehicles of Asian Makes meant for the transportation of persons | Duty and Taxes in US$ or equivalent amount in Pak |

| Up to 800 cc | US$ 4,800 |

| 801cc to 1000cc | US$6,000 |

| From 1001 cc to 1300cc | US$13,200 |

| From 1301cc to 1500cc | US$18,590 |

| From 1501cc to 1600cc | US$22,550 |

| From 1601cc to 1800cc (Excluding Jeeps) | US$27,940 |

Procedure to Import a Car in Pakistan:

When you are going to import a car to Pakistan from another country you have to follow the below-given procedure step by step.

Step 1: Find out the relevant dealer or online auctioneer for importing a car and talk to him in order to finalize your deal. This dealer or auctioneer will show you the details of the car including the images of the car, specification, and ownership details.

Step 2: Most of the time the auctioneer or import dealer asks you for hiring a custom agent for you who took the responsibility to bring your car from that country to the doorstep of your home or address you want to import the car. Besides this, you can also hire a customs agent on your own. You have to meet with an agent in order to finalize the price and other terms and conditions to import one car or bulk of cars. (Always hire an authentic and well-known agent in case of any fraud)

Step 3: once you place the order then your order will be valid for 15 days so never late to pay the charges within the given limit otherwise you will be charged a fine and you are responsible for any type of damage to your product.

Pakistan Car Import Duty 2025:

AS I have mentioned in the top above passage that FBR Pakistan has recently increased the custom duty rates up to 30%.

| New Sport-Utility Vehicles (SUVs): | 80% tax, up from 50% |

| Old and Used Sport-Utility Vehicles (SUVs) 1801cc-3000cc: | 60% unchanged |

| New Cars and Jeeps 1801cc-3000cc: | 80% up from 50% |

| Used Cars and Jeeps 1801cc-3000cc: | 60% unchanged |

| New Cars and Jeeps above 3000cc: | 80% up from 50% |

| Used Cars and Jeeps above 3000cc: | 60% unchanged |

| New All-terrain vehicles: | 80% up from 50% |

| Old and Used All-terrain vehicles: | 60% unchanged |

| New Cars and Jeeps Above 2000cc: | 80% up from 50% |

| Used Cars and Jeeps Above 2000cc: | 60% unchanged |

| New Cars and Jeeps Above 2500cc: | 80% up from 50% |

| Used Cars and Jeeps Above 2500cc: | 60% unchanged |

| New Other: | 80% up from 50% |

| Old and Used Other: | 60% unchanged |

| Vehicles with a cylinder capacity exceeding 1000cc but not exceeding 1300cc: | 15% unchanged |

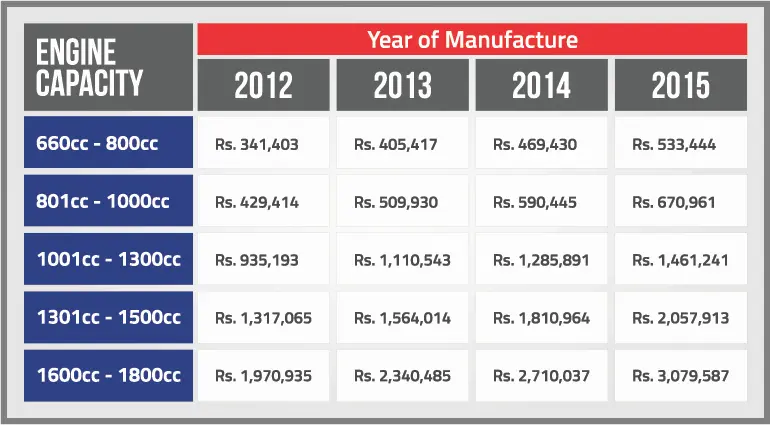

For the Previous Models From 2012 to 2015 Duties, You Can See the Following Chart:

Pakistan Car Import Duty 2025 Calculator:

- The total price of the vehicle

- Cost and Freight Charges (C & F)

- Import or Custom Duty Charges (According to the Displacement cc and Model Year)

- Passport Fees

- Custom Agent Fees

- Transportation Charges From Karachi Port to the point of delivery in Pakistan

- Other expenses like Challan Fees, Excise, and Documentation Charges

The Pakistan car import custom duty varies according to the value of the car about the displacement cc, the model year, and the country you are importing your car. So that is why there is no fixed amount we can state about ingress a car in Pakistan from other countries.

How to Pay Pakistan Car Import Duty 2025

After all the above information, this is also important for you to know how to pay Pakistan car import duty 2025. Well, it all depends upon the custom agent you are hiring. But we recommend that you must visit the FBR custom duty office in order to clarify your payment methods. Apparently, it looks like a very easier task to pay the amount but actually, this is a very fiddly process about deciding to whom you are paying your payments.

I am hoping you all are now well aware of this piece article about the Pakistan Car Import Duty 2025 Calculator How to Pay. But in case you have any comments you can send them in the comments below.

helo sir i have a 4*4 jaguar modal 2019/ 2000 cc i am live in belguim but i whant live now in pakistan i take with me my car how much i pay tax all and paper requerd tell me pl thanks